[Editor’s note: Guest blogger Randall Newton continues his occasional series of articles on trends in engineering with this report from the recent FORMNEXT 3D printing conference in Germany.]

Automobile manufacturer Audi is using its A4 Limousine, a low-production model, as a proving ground for process innovation research. One large steel frame section of the A4 has always been difficult to manufacture, so the research team decided to try 3D printing. Audi engineers optimized the design for improved cooling and a 50% weight reduction, and then used Selective Laser Melting (SLM) to create 10,000 pieces.

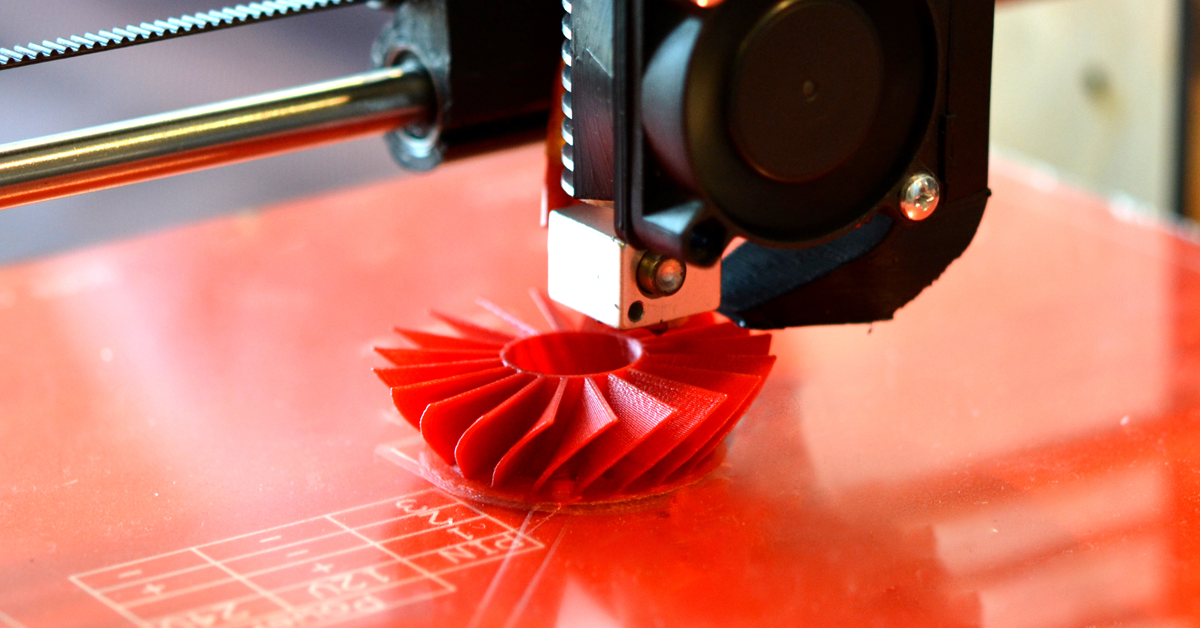

For a generation, 3D printing has gradually gained acceptance as a useful adjunct to product engineering and manufacturing. In recent years, a few manufacturers have created end-use parts; GE Aviation recently celebrated the 3D printing of the 30,000th jet engine fuel nozzle. Now companies are looking beyond prototyping and limited editions and toward the day when 3D printing can produce final parts in the hundreds of thousands.

The Industrialization of 3D Printing Technology

In November, 3D printing vendors showed their newest products at Formnext, a fast-growing annual conference in Frankfurt, Germany. Martin Boch of Audi was a keynote speaker at the Formnext executive conference. “The main goal is the industrialization of 3D printing technology,” says Boch, the project lead for metal additive manufacturing at Audi. His company currently has three basic uses for 3D printing. R&D occupies about 20% of the company’s use of 3D printing; 60% is for prototyping; and another 20% is for creating spare small parts and tooling. Before Audi can move into serial production of small parts, Boch says it must define standard processes for sourcing both printers and materials.

Increased labor costs will be a major factor in the increased use of 3D printing, says Boch. Even though the A4 part design “was interesting,” the post-printing processes (including powder removal) were too expensive. Audi expects labor costs to drop 10-fold by 2025 as vendors and manufacturers work together on process innovation to match current technical capabilities.

GE is doing more than 3D printing jet engine nozzles. It has turned its own use of 3D printing into a separate business unit, GE Additive. “We eat our dog food,” says GE Additive’s Chris Schuppe, referring to the software industry’s description of using one’s own product internally. For a new Boeing 787 part, Schuppe says GE Additive will “make the powder, the [3D printing] machine, the part, and put it in the engine.”

Redefining the 3D Printing Strategy

There is a shift coming in the 3D printing industry, says industry research Dr. Wilderrich Heising of Boston Consulting Group. The very origins of the 3D printing industry was a disruptive event in manufacturing, but vendors now need to be intentionally disruptive about their own products and processes. Heising says, “every player needs to redefine its strategy” to stay in business. Heising foresees a shift among 3D printing vendors, moving from optimization for quality to optimization for speed. When vendors “increase build rate by up to five times at the current level of quality,” Heising says the result will be a total reduction of machine cost per part by more than 50%.

Since 2015, there has been near-parabolic growth in patent activity and published research for polymers and metals for 3D printing, says research analyst Tugce Uslu at Lux Research. This points to increased quality in parts but not necessarily in processes. Uslu notes “positive accomplishments” in software development for 3D printing processes coming from companies like Desktop Metal, Materialise, and Frustum, a CAD startup that was acquired just after Formnext ended by PTC for $70 million.

Uslu says manufacturers looking for the right time to buy into a new process should examine the balance between innovative processes and ecosystem maturity. A new process might provide a technology advantage but be unable to deliver consistently if materials are in short supply.

New Research into Materials

There was plenty of innovative research into materials and processes on display at Formnext. 3D Systems showed a new clear plastic that sets records for clarity, and it debuted its “Digital Factory” production systems for metal and thermoplastic. Cubicure introduced a new photopolymer with high strength and high heat deflection, designed for 3D printing injection molds. GKN Powder Metallurgy demonstrated a new process to create 3D printed inductors from copper. GKN says the unpredictable service life and quality of manually manufactured copper inductors do not meet growing industrial demands. GKN is using selective laser melting (SLM) to produce copper inductors certified to the IATF 16949:2016 standard.

Software vendor ParaMatters presented CogniCAD, a second-generation generative design solution. It is used to create ready-to-3D print high-performance lightweighted structures for aerospace, automotive and other mission critical applications. ParaMatters is one of several companies in new technology incubator XponentialWorks, led by former 3D Systems CEO Avi Reichental.

The future of 3D printing is just beginning, and it’s still full of uncharted territory. It is up to manufacturing organizations to push the ball forward and get it rolling.